The sale of housing recovers to rhythms forced due to the explosion of operations with sales of second-hand houses. We tell you all the news on Elpais.

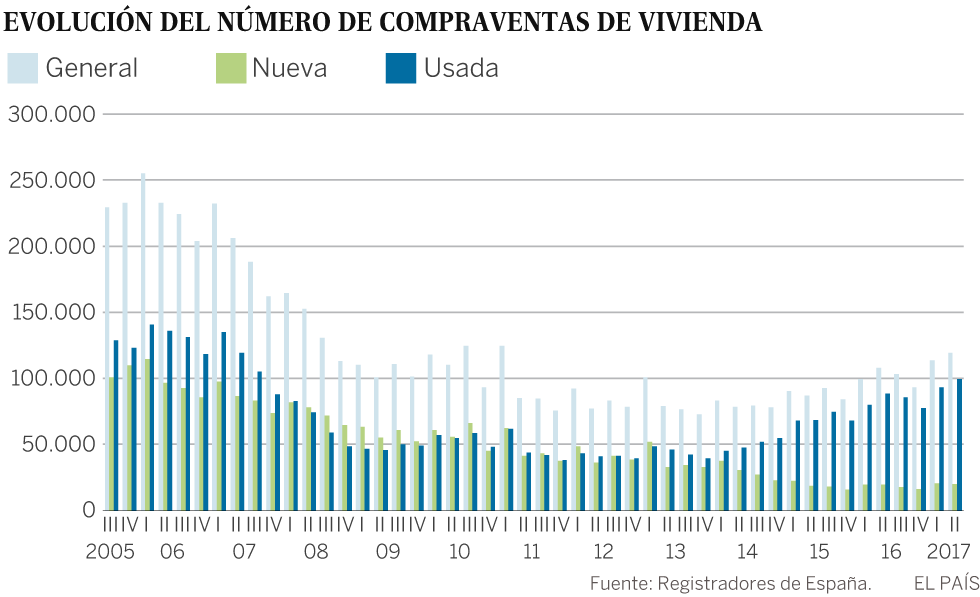

In the second quarter of 2017, they changed hands in conjunction 119.408 real estate and apartments. Of total, 99.343 they were used houses. Used brick has thus marked its highest peak in almost ten years and the sale is placed at the end of June at the level of 2007, before the explosion bubble real estate. While, with only 20.065 operations, the sale of new construction is very stop and away from the 110.000 brand new units that were sold rapidly expanding real estate.

Between new and used dwellings, they were recorded in the second quarter of the year 113.738 purchases and sales, es decir, 5.670 operations more, resulting in an increase of the 4,99%. “To find levels of quarterly housing purchases higher than those achieved in the second quarter of 2017 go back until the first quarter of 2011″, He said Monday in his report the Association of registrars of Spain.

“This circumstance notes clearly evident intensification of the pace of housing sales, featuring a remarkable strength the market by the demand side”, According to the quarterly report. Recovery, However, It is linked to a single leg of the market: of used homes.

New developments, stop

“What sells are second hand houses because it is what it is. No new construction is being built”, sums up Fernando Encinar, co-founder and head of the real estate portal idealistic studies. “Build home has stigmatized. It seems that building is not good and in certain areas need. Because it is true that it is something stock unsold nationwide, but it is in areas where it will not be output”, considered. Criticizes that in cities like Madrid and Barcelona, where there is demand, the municipal permits almost stand. “And if it is not built, We will see a strong rush of prices”, advances.

The output for those who want to buy a House is thus doomed to the second hand market, In addition to properties used, It includes some which arose years ago but were stuck in the hands of developers or banks. “Used housing continues to show a remarkable fortress, giving rise to significant increases in quarter-after-quarter”, explain registrars. Sold 99.343 the second quarter used houses, What as highlighted in the report, “It is the biggest result of the last thirty-nine quarters (nine years and three quarters), must go back to the third quarter of 2007 to find more than on sale and purchase of used housing”, stand out.

As for international buyers, keep your weight on the market and perform the 13% shopping, es decir, 15.600 between April and June. Include the British, with almost the 15% foreign operations; the French, with the 8,5% of the total; and the Belgians, with the 7,8%.

The price, away from the maximum

By the way, What has not recovered, It is the price of the bubble era. The registrars of property have granted mortgages figures. En 2007, Media, they overcame the 150.000 euros. In the second quarter of 2017, stood in 115.769 euros. By communities, the average maximum is recorded in Madrid, con 184.223 Euro mortgage. In the same community, the average mid 2007 was of 223.636 euros.

The real estate crisis in Spain came from the hand of an international financial crisis. At the time of the bursting of the bubble, the euribor, the variable index that relates the vast majority of mortgages to variable type of Spain, was at maximum: in June of 2008 reached the 5,4%. Since then it has plummeted to negative rates. But the recovery has brought with it a new: the granting of fixed-rate mortgages has skyrocketed.

In fixed mortgages, banks set higher than euribor interest, which raises its margin in the short term. To change, families guarantee are quotas fixed and no surprises during every year that the loan lasts, Although the market conditions change. El 38,5% mortgages signed between April and June they were fixed. In the second quarter of the 2007 they were residual, only the 1,2%.

The rise of fixed-term, in the opinion of the director of the Cabinet of studies of the real estate portal Pisos.com, Manuel Gandarias, “It will allow to eliminate the risk of future rises in the interest rate and its impact on mortgage payments. It is an indication of the maturity of the buyers clear, you have a thinking long-term investment in home buying”.